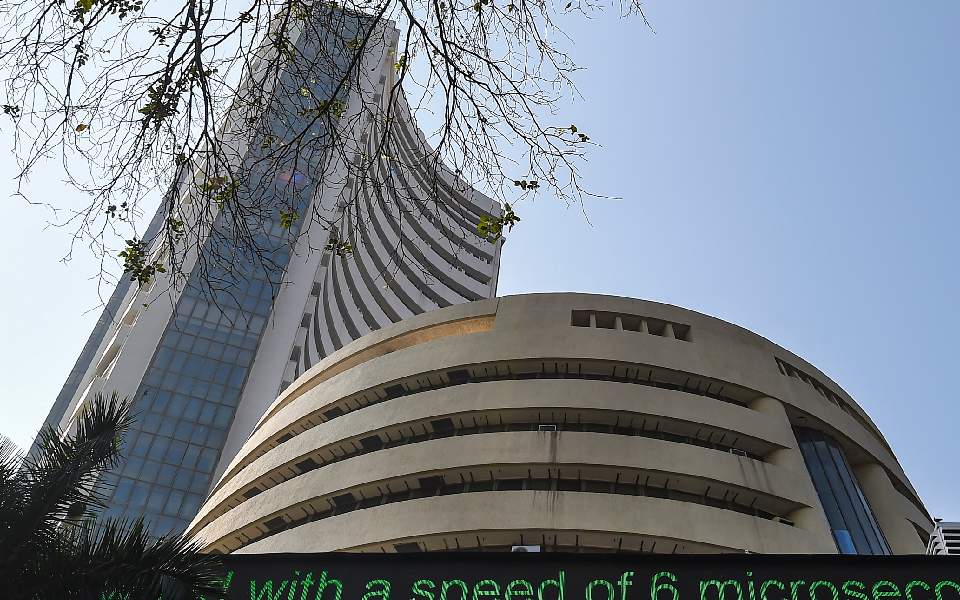

Indian equity indices fall for second straight session as Sensex drops 721 pts and Nifty slips to 24,837, dragged by media, PSU bank stocks, and Bajaj Finance.

The Sensex saw a 721-point decline on Friday, July 25, the penultimate trading day of the week, and ended the day at 81,463. The Nifty closed at 24,837 after dropping roughly 225 points.

Only one of the Indian equity Sensex’s thirty shares was up, while the other twenty-nine were down. Bajaj Finance’s stock fell 4.78%. 15 shares, including those of Power Grid, Tech Mahindra, and Bajaj Finserv, fell 1% to 2.6%.

Seven of the 50 Nifty shares were up, while forty-three were down. The largest decline was 2.61% for the NSE media index, 1.70 for government banking, 1.64% for metal, 1.42% for IT, and 1.27% for auto. Pharma’s stock ended the day up 0.54%.

Global Market Decline

In Asian markets, Korea’s Kospi is up 0.18% at 3,196, while Japan’s Nikkei is down 0.88% at 41,456.

China’s Shanghai Composite is down 0.33% at 3,594, while Hong Kong’s Hang Seng Index is down 1.09% at 25,388.

America’s Dow Jones closed at 44,694 on July 24, up 0.70%. The S&P 500 was up 0.070% at 6,363, while the Nasdaq Composite was up 0.18% at 21,059.

FIIs sold shares valued at ₹2,134 crore on July 24.

Foreign investors (FIIs) sold shares in the cash segment for ₹2,133.69 crore on July 24. The net purchase made by domestic investors (DIIs) was ₹2,617.14 crore.

Foreign investors have sold shares totalling ₹28,528.70 crore so far in July. A net purchase of ₹37,687.38 crore has been made by domestic investors throughout this time.

Foreign investors made a net buy of ₹7,488.98 crore in June. During the month, domestic investors also made a net purchase of ₹72,673.91 crore.

Yesterday, the stock market ended the day down 542 points.

Thursday, July 24, the fourth trading day of the week, saw the Sensex settle at 82,184, down 542 points. When the Nifty closed at 25,062, it had dropped 158 points.

Five of the Sensex’s thirty shares witnessed increases, while twenty-five had decreases. Trent, Tech Mahindra, and Bajaj Finserv’s stock dropped as much as 4%. Sun Pharma, Tata Motors, and Zomato all had increases of up to 3.5%.

Sixteen of the fifty Nifty stocks rose, while thirty-four fell. Realty fell 1.04%, FMCG by 1.12%, and the NSE’s Nifty IT index by 2.21%. The Public Sector Banks, Metal, and Pharma indices all saw increases of up to 1.2%.

The Nifty smallcap and midcap indices fell between 1.63% and 2.16%, indicating broader market weakness, as he also pointed out. Investor confidence is being severely impacted by cautious management rhetoric and mounting worries about earnings disappointments, which are reflected in the recent downturn. Furthermore, the pressure is being increased by FIIs’ ongoing selling, according to Mishra.

He places immediate support at 24,700, with a more substantial foundation in the 24,450–24,550 range, given that the Nifty is currently below 24,900. “Traders should avoid averaging down on trades that result in losses and instead align their positions with the current trend,” Mishra continued.