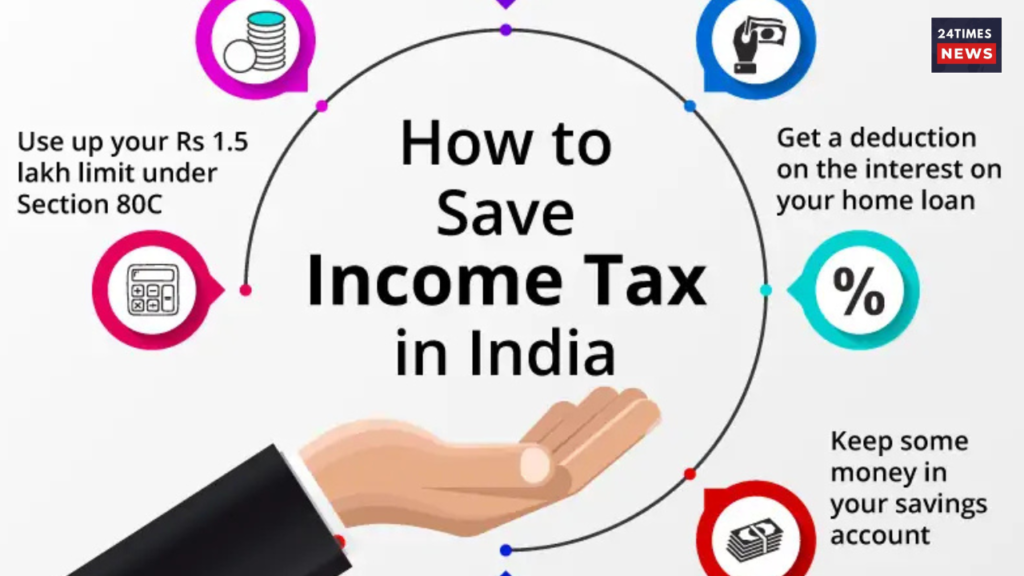

You have only a few last days left for Income tax saving, after this the financial year 2025 will close and your tax will be deducted, if you also want to save your tax then for this, submit all the proofs related to your investment before 31 March 2025.

Income Tax Saving: Financial year 2025 is about to end and this is your last chance to save your tax. If you have not done this most important work yet, then do it now and submit all the proofs related to your investment to the Income Tax Department as soon as possible. By doing this, you will be able to save your tax to a great extent and if you do not do this, then your tax will be deducted.

It is necessary to submit investment proof before 31st March 2000, you have to submit your investment proof for Income tax saving. If you are a tax payer then you have to submit the documents related to your income tax to the income tax department, whereas if you have invested in any saving scheme, then for this you have to submit the documents of your saving investment, due to which you are given the benefit of tax exemption under section 80c, 80d and 80G. By submitting investment proof, you can avoid deduction in your TDS, apart from this you also get convenience during tax return.

There are some saving schemes for Income tax saving in which you can save your tax by investing. Let us know about some such special schemes-

Investing in FD

You can income tax saving by investing in FD. Investing in FD is considered a safe option and in this you get your money after a certain period, while you are given an interest rate of 7% to 9%, for this you have to invest in it for at least 5 years, in which you get a deduction of up to 1.30 lakhs while paying income tax.

Senior Citizen Saving Scheme

You can income tax saving by investing in Senior Citizen Saving Scheme. This saving scheme is for senior citizens. Applicants above 60 years of age can invest in it. The interest rate given in this is up to 8.02 percent. It is necessary to invest at least for 5 years. There is no benefit of income tax return on investment of less than 5 years. In this, you get a deduction of up to Rs 1.50 lakh under section 80c of tax.

Sukanya Samriddhi Yojana

You can also save income tax by investing in Sukanya Samriddhi Yojana. This account is opened for 10-year-old girls and it gives an interest rate of 8.2 percent. In this scheme, you can invest from Rs 250 to Rs 1.50 lakh and you get tax exemption of up to Rs 1.50 lakh.

Investing in NPS

Income tax can also be saved by investing in NPS (National Pension System), in which you can open an account through any NPS bank account and by investing in it, you can get income tax exemption up to ₹ 200000.