ITR Filing Last Date 2025

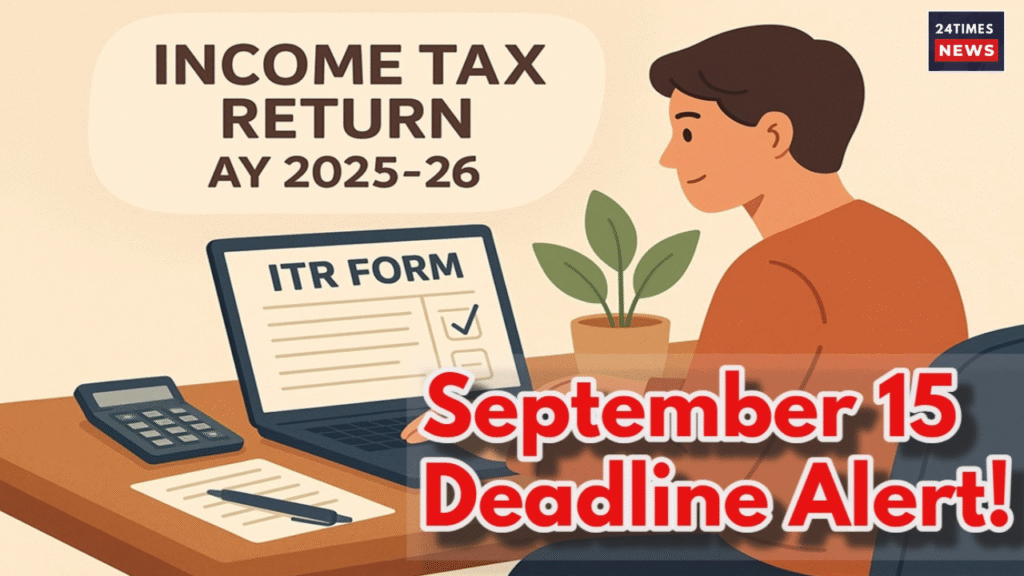

ITR Filing Last Date 2025: If you are also an income tax payer and file tax returns, then this news is for you, because the Income Tax Department has extended the last date for filing ITR, earlier the deadline for filing ITR was 15 September which has been extended to 16 September. To file ITR, you can file ITR by visiting its official website. There were also many tax payers who were not able to file ITR due to the slow speed of the portal because either due to technical fault or slow speed of the website, they were unable to file ITR.

Now this is good news for those users, they have another chance, those who have not yet filed ITR, they should file their income tax return as soon as possible. Filing income tax is necessary for those people who are small businessmen, pensioners and employees and for those whose accounts will be audited, the last date for filing ITR has been fixed as 31 October 2025.

The Income Tax Department has posted information on

the Income Tax Department has given information about the extension of the deadline of ITR Filing Last Date 2025. The Income Tax Department has posted on , in which they have written that “The date for filing ITR for 2025-26 was originally 31 July 2025, after which it was extended to 15 September 2025, now the last date for filing ITR has been extended from 15 September to 16 September. “

What will happen if ITI return is not filed today

ITR Filing Last Date 2025 is today, those who do not file ITR return before its last date will be fined up to ₹ 5000 under section 234F of the Income Tax Act, while tax payers whose annual income is less than 5 lakhs will have to pay a fine of up to ₹ 1000.

It is necessary for these people to file ITR

ITR Filing Last Date 2025 was 15 September, which has now been extended to 16 September, in such a situation, it is necessary for the non-audit tax payer to file ITR today otherwise they may have to pay a fine. Salaried persons, pensioners and small businessmen come under non-audit tax payer, while the last date for filing ITR for audit tax payer is 31 October 2025. Audit tax payers include such taxpayers whose accounts are required to be audited.

Who needs to fill ITR?

Salaried persons, pensioners and people who generate income from house property need it. Apart from this, people who are directors in any company and generate income from lottery, horse race etc., people generating income from capital gains also need to file ITR.