PM SVANidhi Credit Card: The central government launched the PM SVANidhi scheme for street vendors, hawkers, and small shopkeepers working in urban areas. Now, PM Modi has further expanded this scheme by launching a credit card scheme. This means that credit cards will now be available not only to the wealthy but also to the poor, street vendors, and other vendors. By launching this scheme, PM Narendra Modi has provided significant relief to the poor, enabling them to meet their daily needs through this credit card.

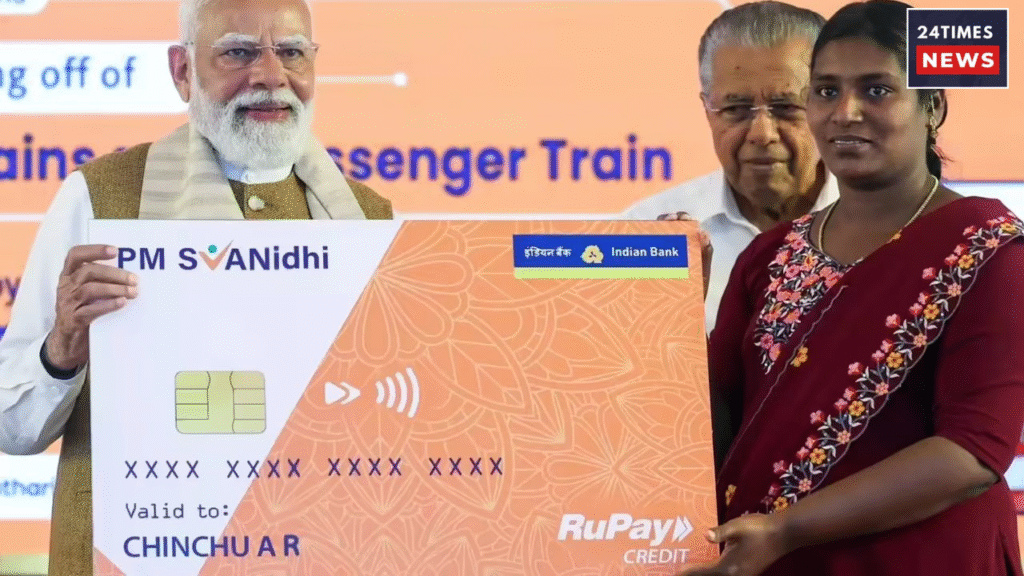

This scheme, launched in Kerala on Friday, January 23rd, offers loans without guarantee. This PM SVANidhi scheme was launched during the COVID-19 pandemic, providing loans up to ₹50,000 to street vendors without guarantee. Now, the central government has announced the availability of credit cards under this scheme.

What is the PM SVANidhi Credit Card?

PM SVANidhi Credit Card Launched by the central government for street vendors, this card is primarily given to street vendors who have already taken out loans under the PM SVANidhi scheme and are making timely payments. Under this scheme, they can take out loans to expand their small businesses and, by repaying the loan on time, can also avail of a credit card. There’s no need to pledge any property, meaning you can easily obtain this loan without any guarantee.

Features of PM SVANidhi Credit Card

The features of PM SVANidhi Credit Card are as follows: –

- It has a credit limit of ₹10,000 initially, which can be increased to ₹30,000 if repaid on time.

- This card has an interest-free period of 20 to 50 days, and no interest is charged on repayments during this period.

- The special feature of this credit card is that it runs on the RuPay network and can also be linked to UPI, allowing street vendors to easily make payments by scanning a QR code.

- No guarantee or security is required to obtain this card.

- Those who have taken a loan under the PM SVANidhi scheme and are repaying it on time are eligible.

- This card is valid for 5 years.

Eligibility for PM SVANidhi Credit Card

Street vendors who have repaid their second loan of ₹20,000 on time under the PM SVANidhi scheme are eligible for a ₹50,000 loan. Applicants between the ages of 21 and 65 are eligible to apply. Applicants must have a good credit score and not be bank defaulters.

Benefits of PM SVANidhi Credit Card

This credit card has many benefits –

- cashback is given on digital transactions in which cashback up to ₹1200 is available i.e. cashback of ₹100 is given every month.

- In this, if small traders suddenly need to buy goods or if they suddenly need money for daily expenses, then it works as an emergency fund through which the traders can easily make payments.

- If you use this credit card properly and pay it on time, then your credit score improves.

- If you want to do a big business in future, then you can easily get a loan for it.