Pan Card

A PAN (Permanent Account Number) card is an essential identity document for taxpayers in India. It is issued by the Income Tax Department and serves as a unique identifier for individuals and entities conducting financial transactions. Applying for a PAN card online is a straightforward and convenient process. This article provides a detailed, step by step guide to help you apply for your PAN card online quickly and efficiently.

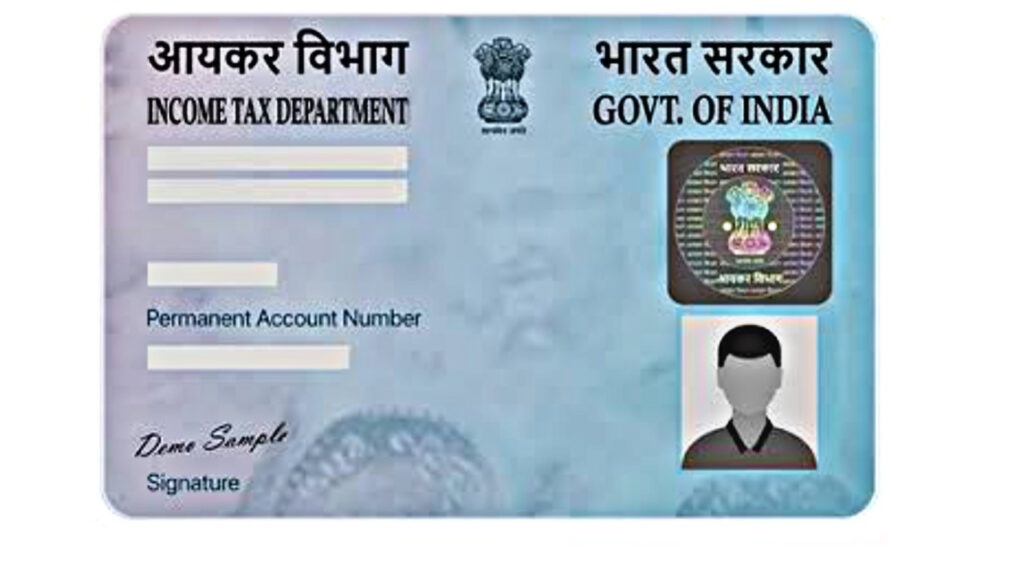

What is a PAN Card?

A PAN card is a 10 digit alphanumeric identifier issued by the Indian Income Tax Department. It is mandatory for all Indian residents who file income tax returns, open bank accounts, or engage in significant financial transactions. Besides individuals, businesses and organizations also require a PAN card.

Documents Required for Online PAN Card Application

Before starting your online application, make sure you have the following documents handy:

- Proof of Identity (Aadhar Card, Passport, Voter ID, Driving License)

- Proof of Address (Aadhar Card, Passport, Utility Bill, Bank Statement)

- Proof of Date of Birth (Birth Certificate, Passport, Matriculation Certificate) Recent Passport Size Photograph Valid Email ID and Mobile Number for communication.

Step-by-Step Process to Apply for PAN Card Online

Step 1: Visit the Official Website

To apply online, visit the official portals:

NSDL: https://www.tin-nsdl.com

UTIITSL: https://www.utiitsl.com

Both websites allow you to apply for a new PAN or make corrections in an existing PAN card.

Step 2: Select Application Type

Choose the correct form based on your requirement:

Form 49A for Indian citizens

Form 49AA for foreign citizens

Step 3: Fill in the Application Form

Enter all your personal details accurately, including your full name, date of birth, contact details, and address. Make sure to double-check all entries as errors can cause delays.

Step 4: Upload Supporting Documents

Upload scanned copies of the required identity, address, and date of birth proofs. Also, upload your recent passport-sized photograph and signature if required.

Step 5: Pay the Application Fee

The fee for PAN card application is nominal. You can pay online using debit card, credit card, net banking, or demand draft. The fee differs slightly for Indian residents and foreign citizens.

Step 6: Submit the Application

After payment, submit your application. You will receive an acknowledgment number, which you must save for tracking your PAN card status.

Step 7: Send Physical Documents (If Required)

In some cases, you may need to send signed physical copies of your application and documents to the processing center via post or courier. Follow the instructions provided on the acknowledgment receipt.

Track Your PAN Card Application

You can check your PAN application status online on the NSDL or UTIITSL portals by entering your acknowledgment number. The process usually takes 15-20 working days.

Benefits of Applying for PAN Card Online

- Easy and convenient from the comfort of your home.

- Quick submission and tracking of application status.

- Minimal paperwork and hassle-free process.

- Secure payment options.

Applying for a PAN card online is a simple and efficient way to obtain this crucial document without visiting government offices. Make sure to provide accurate details and upload the correct documents to avoid any delays. By following this detailed guide, you can get your PAN card delivered to your address within a few weeks. Get started today and secure your financial identity with a PAN card.